How to get an EIN for LLC (Online)

2025 LLC Guide

Also known as: How to Apply for a Federal Tax ID Number for an LLC.

This lesson is about how to get an EIN for an LLC, not another type of business or trust. Also, you can only apply for an EIN online if you have a Social Security Number (SSN) or an Individual Taxpayer Identification Number (ITIN).

Note: The video above shows obtaining an EIN for an LLC in California, however, the steps will be similar regardless of which state you formed your LLC in. Also, this video is a few years old and a few things have changed with the online EIN Application. Please read this entire lesson before applying for an EIN for your LLC.

Online EIN Application for LLC

Hours: The EIN Online Application is only available Monday through Friday, from 7:00am to 10:00pm Eastern Time.

Reminder: The instructions below are only for people who have an SSN or an ITIN. If you are a foreigner and don’t have an SSN or ITIN, you can still get an EIN for your LLC. Please see the instructions here: How to get an EIN without an SSN or ITIN.

Get started:

Visit the EIN for LLC Online Application:

IRS: Apply for an Employer Identification Number (EIN) Online

Click the blue “Apply Online Now” button in the middle of the page.

Read through the important information and then click “Begin Application“.

1. Identify

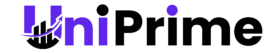

What type of legal structure is applying for an EIN?

Select “Limited Liability Company” and then click “Continue“.

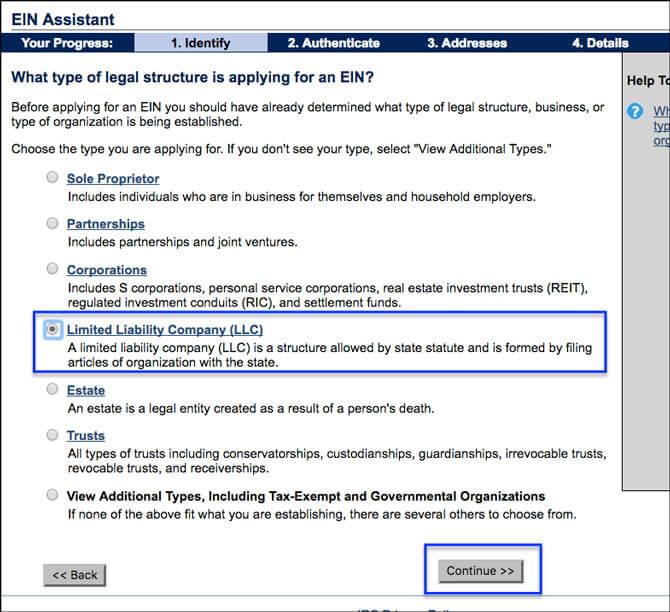

You have chosen Limited Liability Company.

This page explains what an LLC is and what an LLC is not. Please read over the information and then click “Continue“.

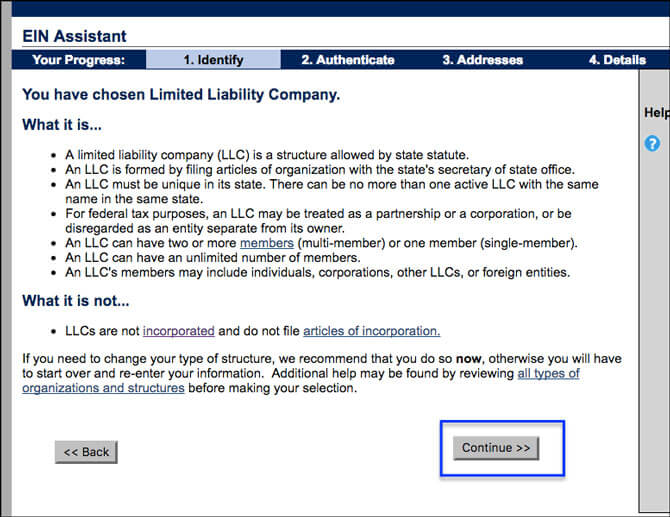

Tell us more about the members of the Limited Liability Company (LLC).

Enter the total number of LLC Members. Then select the state where your LLC was formed and click “Continue“.

Note: LLCs can be taxed by the IRS a few different ways. By default, LLCs with 1 member will be taxed like a Sole Proprietorship. And by default, LLCs with 2 or more members will be taxed like a Partnership. If you want your LLC to be taxed like a C-Corporation or an S-Corporation, you’ll do that with a separate form after the EIN is approved (we’ll discuss this later on). Additionally, how your LLC is taxed by the IRS has nothing to do with your LLC’s liability protection. Your personal assets will still be protected regardless of how your LLC is taxed by the IRS.

Husband & Wife LLCs in Community Property States

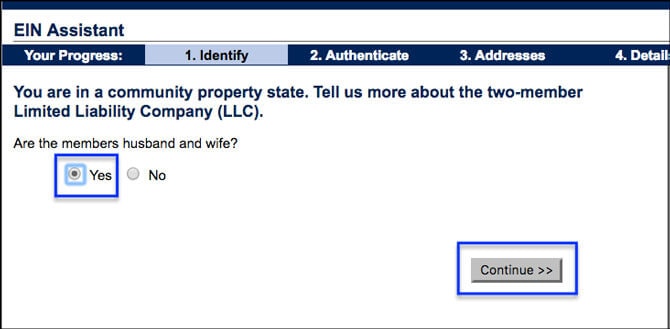

If you select 2 members and are forming an LLC in a community property state, the IRS will then ask you how you’d like to be taxed and whether or not you want to be a Qualified Joint Venture LLC.

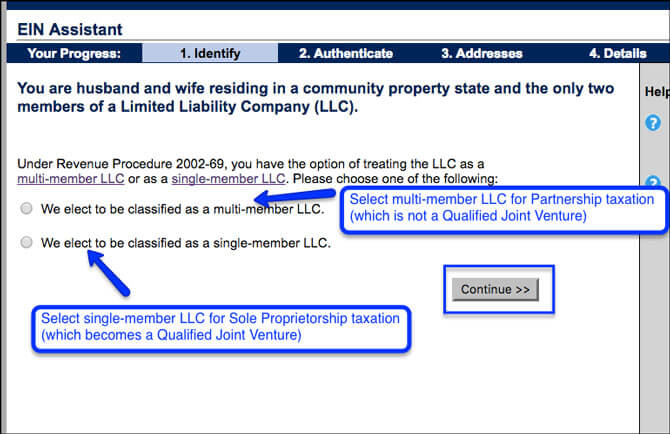

A Qualified Joint Venture LLC is when an LLC is formed in a community property state, the only owners are the husband and wife, and they file a joint tax return, they may elect to treat the LLC as being owned as one “legal unit”, meaning the LLC can choose to be taxed as a Sole Proprietorship (instead of a Partnership). So by making this election, the married couple will not be required to file a 1065 Partnership Return, but will instead report income, losses, credits, and deductions directly on their joint tax return.

You’ll see the following:

If you select “multi-member LLC“, your husband and wife LLC will be taxed as a Partnership, which is not a Qualified Joint Venture.

If you select “single-member LLC“, your husband and wife LLC will be taxed as a Sole Proprietorship, which is a Qualified Joint Venture.

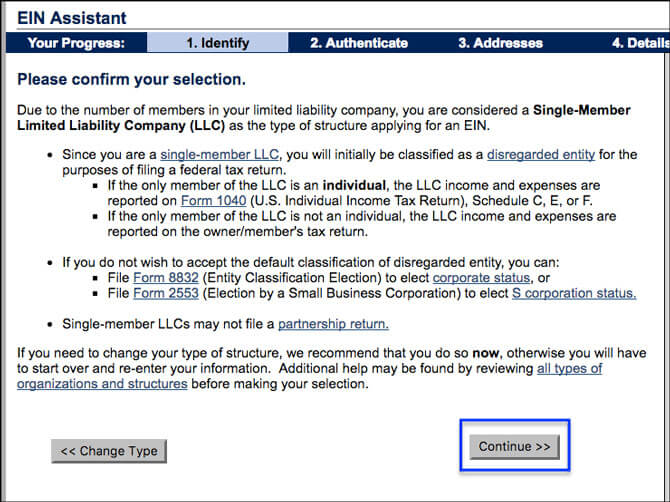

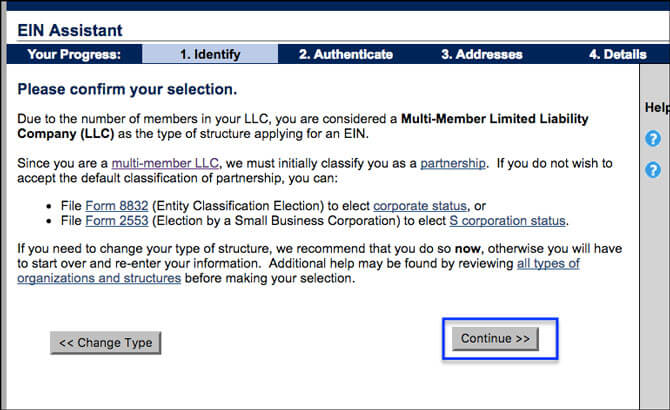

Please confirm your selection:

This page will confirm and explain the IRS tax classification for your LLC.

If you have a Single-Member LLC, the IRS will treat your LLC as a “disregarded entity” and the LLC will be taxed like a Sole Proprietorship. Keep in mind, this has nothing to do with your liability protection. You are still operating as an LLC and have its full personal liability protection. The IRS is just taxing it like a Sole Proprietorship.

Your LLC’s income will “pass through” to your personal tax return, known as Form 1040, and your income will be reported on a Schedule C, E, or F. You’ll see the following message:

If you have a Multi-Member LLC, the IRS will tax your LLC like a Partnership. Keep in mind, this has nothing to do with your liability protection. You are still operating as an LLC and have its full personal liability protection. The IRS is just taxing it like a Partnership.

Your LLC’s income will “pass through” to your personal tax return (on Form 1040), but you’ll also need to file a 1065 Partnership Return and issue a K-1 to each LLC Member. You’ll see the following message:

Note:

You’ll see a message stating that if you do not want to accept the LLC’s default tax classification, you can file Form 8832 and have your LLC taxed as a C-Corporation, or, more popularly, you can file Form 2553 and have your LLC taxed as an S-Corporation. Please note, that even if you plan on filing either of these forms, you’ll need to continue through the process of the online EIN application, and after your EIN is approved, you can then file Form 8832 or Form 2553. But make sure you speak to an accountant regarding which method of taxation is best for your LLC. For people starting out (earning less than $50,000 per year), it usually won’t make sense to have your LLC taxed as an S-Corporation or a C-Corporation, however, as mentioned, please speak with an accountant.

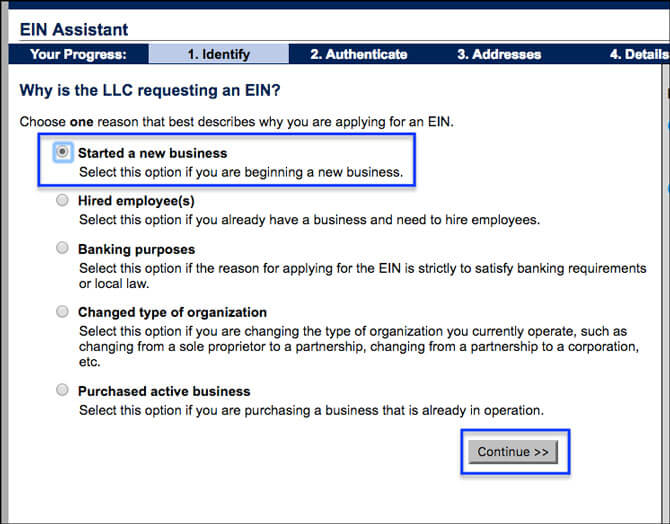

Why is the LLC requesting an EIN?

Most people select “Started a new business” and then click “Continue”.

2. Authenticate (EIN Responsible Party)

The EIN Responsible Party is a person that goes on file with the IRS when you apply for an EIN for your LLC.

Think of the Responsible Party as the LLC “contact person”. The IRS will send mail about your LLC’s taxes to this person.

The Responsible Party must have an SSN or ITIN, if you’re applying for an EIN online.

Tip: If you’re non-US resident and don’t have an SSN or ITIN, you can still get an EIN for your LLC. Please see this page: How to get an EIN without SSN.

If you have a Single-Member LLC: You will be the EIN Responsible Party.

If you have a Multi-Member LLC: One of the LLC Members will be the EIN Responsible Party.

The IRS just wants one person as the EIN Responsible Party. They don’t want all the LLC Members’ information. The IRS gets the other Members’ information when you file your 1065 Partnership return.

Although any LLC Member can be listed, you should list the LLC Member that will take on the responsibility of making sure the LLC taxes are handled properly.

Note: If you need to change your EIN Responsible Party later, please see this page: Change EIN Responsible Party for LLC.

What if my LLC is owned by another company?

The IRS rules changed in 2018 to say that the EIN Responsible Party cannot be another company. The EIN Responsible Party must be an individual person.

If your LLC is owned by another company, list an owner of the parent company.

Note: If your EIN Confirmation Letter says “[YOUR NAME], SOLE MBR” at the top, don’t worry. The system prints “SOLE MBR” automatically. The IRS is only looking for a Responsible Party, and doesn’t care whether your LLC is owned by another company. The “SOLE MBR” on the letter doesn’t make you a member of the LLC, and doesn’t change the fact that the LLC is owned by another company. This is just a system bug, and the IRS doesn’t actually think you’re the owner. For more details, please see What does SOLE MBR and MBR for LLC mean.

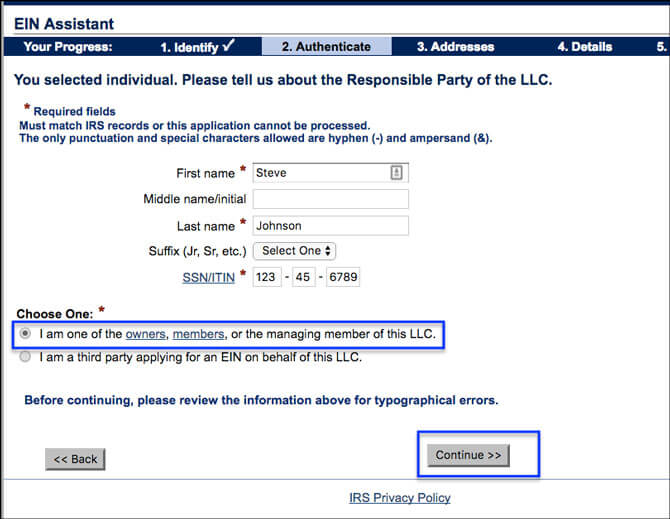

Please tell us about the Responsible Party of the LLC:

Enter your full name and your SSN or ITIN. Then select “I am one of the owners, members, or the managing member of this LLC“. Then click Continue to proceed.

ITIN Number: If you are entering your ITIN number, please note, that there is a 30-40% chance you will receive an error message (called a reference number) at the end of the EIN Application. There are many reasons this might happen. For example, your ITIN may not be established in the IRS system yet. If you receive an error message at the end, don’t worry, you can still get an EIN for your LLC. You just need to mail or fax in Form SS-4 instead. You can find instructions here: apply for EIN with Form SS-4.

3. Addresses

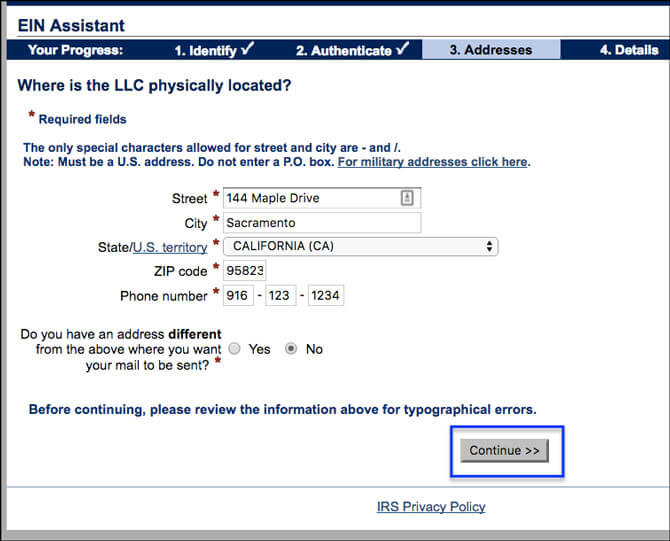

Where is the LLC physically located?

Enter your LLC’s physical address and your U.S. phone number.

The IRS will use this address to send your LLC any mail or correspondence.

The IRS rarely calls people, but in case they need to, use a reliable phone number where you can be reached. The number must be a U.S. telephone number. It can be a cell, home, or office number.

A P.O. Box address is not allowed. A physical street address must be entered.

Most filers list their home if they work from home or an office address if they work from an office. You can also can use a PMB (Private Mailbox Service) or a CMRA (Commercial Mail Receiving Agency) address if you have one.

Note: If you need to change your address later, we have instructions here: Change your LLC address with the IRS.

Non-US residents:

If you formed an LLC in the U.S., but you don’t actually have a physical location in the U.S., you can use the address of your Registered Agent (if they allow it). One such company that is “foreigner-friendly” and will let you use their address is Northwest Registered Agent.

Special characters:

The only special characters that are allowed in the address fields are a hyphen (-) and a forward slash (/). You can’t use the number sign (#), a comma, or a period.

For example, if your address is “123 Main Street, Apt. #3”, you’ll need to enter it as: “123 Main Street – Apt 3” or “123 Main Street Apt 3“.

Different Mailing Address:

If you want mail from the IRS to be sent to a different address than you entered, select “Yes” and enter that address on the next page. The IRS will use this address as your mailing address instead of the LLC’s physical location.

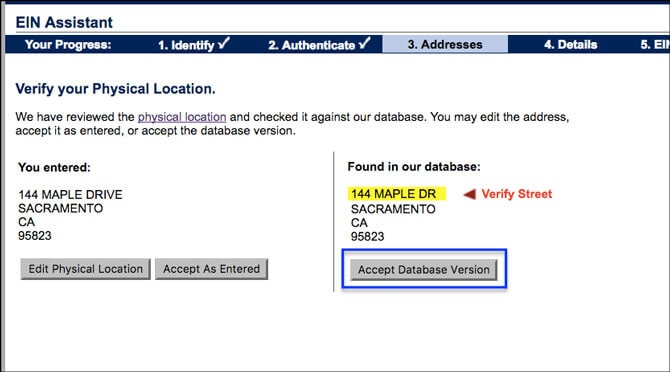

Verify your Physical Location:

If the following page appears, it just means the IRS is formatting your address to match up with the “standardized format” from the United States Postal Service. You can click “Accept Database Version” and then click Continue.

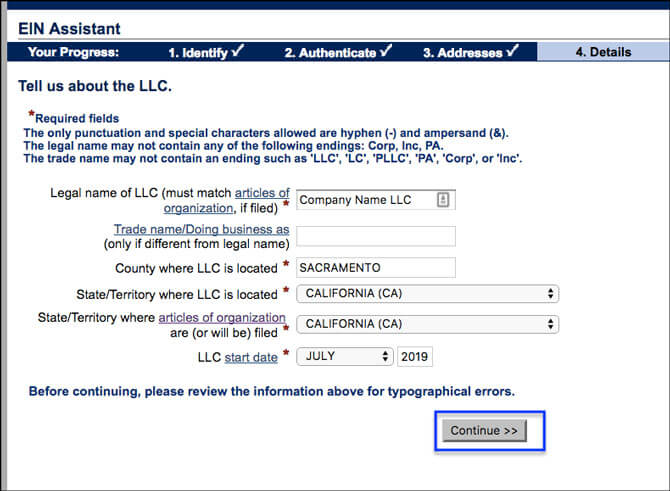

4. Details

Tell us about the LLC:

Legal name of LLC:

Enter the full name of your LLC, but don’t use any periods or commas.

Even if your LLC was filed with the state using a comma, a period, or some other symbol, the IRS will only allow the use of a hyphen (-) and the ampersand symbol (&) in the name field.

Keep in mind, this doesn’t affect the legality of how your LLC filed with the state. It’s simply the IRS “normalizing” their records for their database. Again, it won’t impact the legal name of your LLC.

For example: If your LLC was formed with the name “ABC Widgets, LLC“, it must be entered as “ABC Widgets LLC“.

Symbols in your LLC name:

The IRS doesn’t allow most special characters in the name field. If your LLC name includes any of the symbols below, they will need to be replaced.

For example:

- replace “.” with “dot”

- replace “.com” with “dot com” (ex: MySite.com LLC becomes MySite dot com LLC)

- replace “+” with “plus”

- replace “@” with “at”

- replace a “/” or “” with “-“

- remove $ and related symbols

- remove the apostrophe (‘) and don’t use

Trade name/Doing business as:

This field can be left blank, unless your LLC has also filed a DBA (doing business as) name. Most filers leave this blank since their LLC will just operate using the legal name it was filed under.

If you previously had a Sole Proprietorship with a DBA, don’t enter that name here. That is not the same thing. Only enter a DBA if the DBA was filed after the LLC was formed and the DBA is owned by the LLC.

- Related article: For more information on whether or not a DBA is needed for your LLC, please see: Do I need to file a DBA for my LLC?

County where LLC is located:

A lot of people read this too fast and think it says “country” (like the USA). It doesn’t. It’s the county. Each U.S. state is divided into counties.

Enter the county where your LLC is located. If you’re not sure which county your address is in, you can use this tool.

State/Territory where LLC is located:

Enter the state where your LLC was formed.

State/Territory where Articles of Organization are (or will be) filed:

Enter the state where you filed your Articles of Organization, Certificate of Organization, or Certificate of Formation.

For most filers, this field and the one above will be the same state.

Note: If you’re getting an EIN for a Foreign LLC the state names will be different.

LLC start date:

Enter the month and year that your LLC was approved. You can find this date on your LLC’s approved Articles of Organization, Certification of Organization, or Certification of Formation.

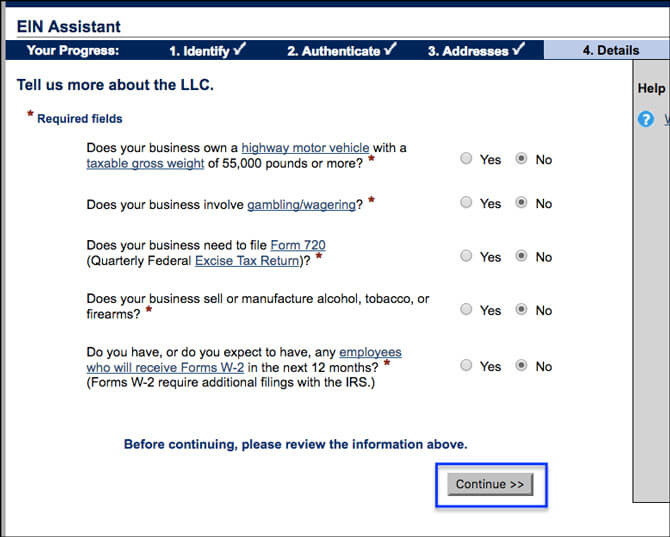

Tells us more about the LLC:

Read the questions carefully and select either “Yes” or “No“, then click Continue.

(Click the links below for explanations from the IRS)

- Does your business own a highway motor vehicle with a taxable gross weight of 55,000 pounds or more?

- Does your business involve gambling/wagering?

- Does your business need to file Form 720 (Quarterly Federal Excise Tax Return)?

- Does your business sell or manufacture alcohol, tobacco, or firearms?

- Do you have, or do you expect to have, any employees who will receive Forms W-2 in the next 12 months? (Forms W-2 require additional filings with the IRS.)

What does your business or organization do?

On the next page, select your LLC’s primary business purpose from the list of given choices.

If it does not fall in any of the choices provided, you can select “Other” and then specify your LLC’s business purpose on the next page. Once you’re done, click Continue.

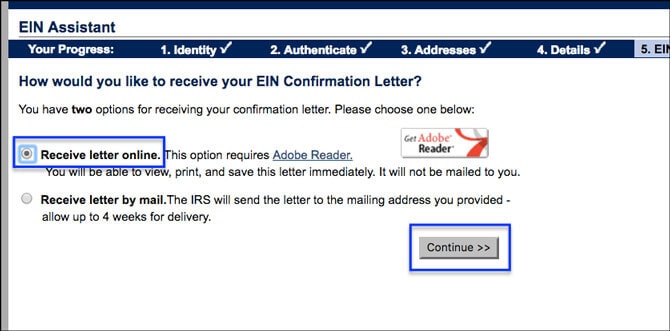

5. EIN Confirmation

How would you like to receive your EIN Confirmation Letter?

We recommend selecting “Receive letter online” as this is the fastest way to receive your EIN Confirmation Letter.

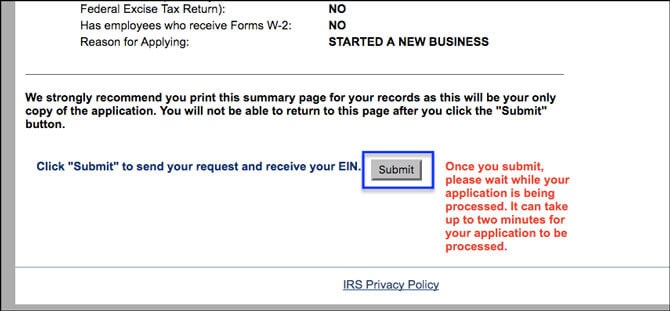

Summary of your information

Review the information you entered, then click “Submit” to finalize your application.

Congratulations, the EIN for your LLC has been successfully assigned!

You’ll see a message confirming that an EIN has been successfully assigned to your LLC.

Important (make sure to download your EIN Confirmation Letter):

Click the blue download link to save and print a PDF copy of your EIN Confirmation Letter. Then click Continue twice to end your online application.

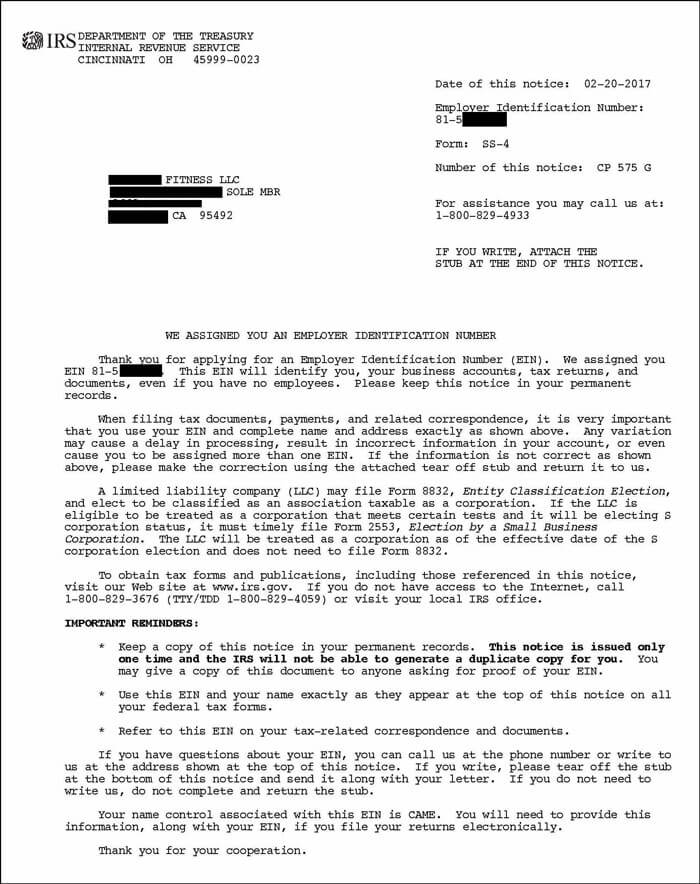

CP-575:

The technical name for your EIN Confirmation Letter for an LLC is the CP 575.

Again, make sure you download and save a few copies of this form.

The IRS will also mail you a duplicate copy, which will arrive in 4-5 weeks.

If you misplace the EIN Confirmation Letter, you can always call the IRS (1-800-829-4933) and request another letter. The IRS won’t be able to issue another CP 575, but that’s okay; they’ll issue another type of EIN letter called the EIN Verification Letter (147C).

The EIN Confirmation Letter is 2 pages. Here is what page 1 looks like:

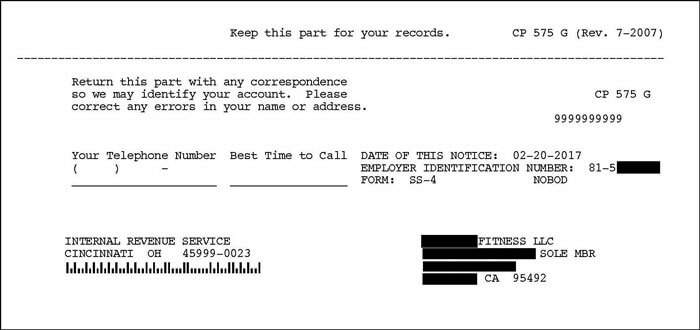

Page 2 has a “cut out”, but you don’t have to mail this into the IRS unless you are sending in a letter and making changes to your LLC’s EIN (which you might do at some point in the future).

Here is what the bottom of page 2 looks like:

EIN Reference Numbers/Error Messages

There are a number of different error messages (called “EIN reference numbers”) that you may receive at the end of the application.

There are many reasons why an online EIN Application may be rejected.

Please reference this page (What do these EIN reference numbers mean?) for more information.

And if you need to file Form SS-4 instead of the online application, you’ll find those instructions here: how to apply for EIN with Form SS-4.

LLC Business Bank Account

Once you get an EIN for your LLC, you’ll be able to open an LLC business bank account.

You’ll need the following items in order to open an LLC bank account:

- EIN Confirmation Letter

- LLC approval (Articles of Organization, Certificate of Organization, or Certificate of Formation)

- LLC Operating Agreement

- Your driver’s license and/or passport

IRS Phone Number & Contact Information

If you have any questions while going through the online EIN Application (or you receive any EIN reference numbers), you can call the IRS at 1-800-829-4933.

The IRS hours are Monday through Friday between 7am and 7pm. The earlier you call, the shorter the wait times.

About Us

We specialize in guiding individuals through the process of forming LLCs across all states, while also offering a range of comprehensive business services tailored to entrepreneurs.

Basics

Our Services

contact details

- support@uniprime.online

- +1 (646) 347-3833

- 1494 State St, Schenectady, NY 12304,