Getting Your Free Alabama EIN Number

(A Simple Guide)

2025 LLC Guide

Special Offer alert!

forms your LLC with Northwest for $39 (60% off). Details inside.

How to Get an Alabama EIN Number for Your LLC (Easy Guide)

Learn how to get an Alabama EIN number for your LLC, for free Step-by-step instructions simplify the process.

Don’t let the IRS intimidate you! Getting an EIN (Employer Identification Number) for your Alabama LLC is a straightforward process, and it’s completely free.

What is an EIN?

Think of an EIN as your LLC’s social security number. It’s a unique identification number assigned by the IRS (Internal Revenue Service) to your business. This number is essential for various business activities, such as:

- Filing taxes

- Opening a bank account

- Hiring employees

- Applying for business licenses and permits

Important Note: EINs are issued by the IRS, not by the Alabama Secretary of State or the Alabama Department of Revenue.

Need an LLC? Northwest forms it for $39 + state fee (add EIN to your order).

Already have an LLC? but need an EIN Northwest can help:

EIN Synonyms:

You might encounter different terms for an EIN, but they all refer to the same thing:

- EIN Number

- Employer Identification Number

- Federal Employer Identification Number (FEIN)

- Federal Tax ID Number

- Alabama Federal Tax ID Number

- Federal Tax Identification Number

EIN vs. Alabama Tax ID Number:

Don’t confuse an EIN with an Alabama Tax ID Number. An EIN is issued by the IRS for federal tax purposes, while an Alabama Tax ID Number is issued by the Alabama Department of Revenue for state tax purposes.

Key takeaway:

Obtaining an EIN for your Alabama LLC is a crucial step in establishing your business. It’s a free and simple process that can be done online through the IRS website.

Why Your Alabama LLC Needs an EIN

An EIN (Employer Identification Number) is a must-have for your Alabama LLC. It’s like a social security number for your business, allowing you to participate in various essential activities.

Here’s why you need an EIN for your Alabama LLC:

1. Financial Transactions

- Open a Business Bank Account: Most banks require an EIN to open a business bank account. This separates your personal and business finances, which is crucial for liability protection and accurate record-keeping.

- Obtain Business Credit: Whether you’re applying for a business loan, line of credit, or credit card, an EIN is often required to establish your business creditworthiness.

2. Tax Compliance

- File Tax Returns: You’ll need an EIN to file your federal, state, and local tax returns. This includes income tax, sales tax, and any other taxes applicable to your business.

- Alabama Income Tax: Even though LLCs don’t pay federal income tax directly, you’ll still need an EIN to file your Alabama income tax return.

- Sales Tax Registration: If your LLC sells taxable goods or services, you’ll need an EIN to register for Alabama sales tax.

3. Other Business Activities

- Obtain Licenses and Permits: Many business licenses and permits require an EIN as part of the application process.

- Hire Employees: If you plan to hire employees, you’ll need an EIN to withhold taxes from their wages and file payroll tax returns.

An EIN is essential for operating your Alabama LLC legally and efficiently. It enables you to open bank accounts, obtain credit, comply with tax regulations, hire employees, and conduct various other business activities.

How much does it cost to get an EIN?

Getting an EIN for Your Alabama LLC is Free

You read that right! The IRS doesn’t charge any fees to apply for an EIN. You can get this essential identification number for your Alabama LLC without spending a dime.

Avoid Paid EIN Services

Be wary of websites or services that try to charge you for obtaining an EIN. You can apply directly through the IRS website for free.

When to Apply for Your EIN

It’s best to wait until your Alabama LLC is officially approved before applying for an EIN. This ensures that all your business information is accurate and up-to-date.

Need to Fix an EIN Mistake?

If you applied for an EIN before your LLC was approved or made another error, don’t panic! for guidance on correcting common EIN mistakes Check out our FAQs below.

Key takeaway:

Getting an EIN for your Alabama LLC is a free and essential step in establishing your business. Don’t fall for paid services – apply directly through the IRS and save your money.

How to Apply for an EIN for Your Alabama LLC

Getting an EIN for your Alabama LLC is essential, and thankfully, it’s a free and relatively simple process. Here’s a breakdown of how to apply:

Important Note:

Finalize your LLC’s membership (single-member or multi-member) before applying for an EIN; changes later require extra paperwork.

Understanding Your EIN Confirmation Letter (CP 575)

For US Citizens and Residents:

If you have a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), the easiest and fastest way to apply for an EIN is online.

- Online Application: The IRS website offers a streamlined online application that takes about 15 minutes to complete. You’ll receive your EIN immediately upon submission.

- Step-by-Step Instructions: We provide detailed instructions on how to apply for an EIN online here

Alternative Methods (Not Recommended):

You can also apply for an EIN by mail or fax, but these methods are significantly slower. Only use them if you encounter an error with the online application and the IRS instructs you to do so.

For Non-US Residents:

If you’re a non-US resident and don’t have an SSN or ITIN, you can still obtain an EIN for your Alabama LLC. However, you cannot apply online.

- Form SS-4: You’ll need to complete Form SS-4 (Application for Employer Identification Number) and mail or fax it to the IRS.

- Step-by-Step Instructions: We provide detailed instructions on how to apply for an EIN without an SSN or ITIN here

No Need for a Third-Party Designee:

You can apply for an EIN yourself without hiring a third-party designee.

Applying for an EIN for your Alabama LLC is a crucial step in establishing your business. By following these instructions and choosing the appropriate application method, you can obtain your EIN quickly and easily.

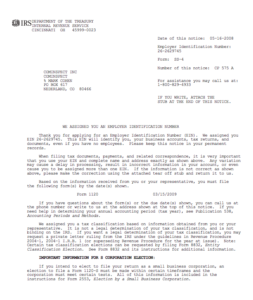

After the IRS approves your EIN application for your Alabama LLC, they’ll send you an official confirmation: the EIN Confirmation Letter (CP 575). This letter serves as proof of your EIN and contains important information about your business.

How You Receive Your EIN Confirmation Letter:

- Online Application: If you applied for your EIN online, you can usually download the EIN Confirmation Letter immediately after completing the application.

- Mail or Fax Application: If you applied by mail or fax using Form SS-4, the IRS will mail the EIN Confirmation Letter to the address you provided on the form. This can take a few weeks.

What the EIN Confirmation Letter Looks Like:

Important Information on the EIN Confirmation Letter:

- Your EIN: The unique nine-digit number assigned to your LLC.

- Legal Name and Address of Your Business: The official name and address of your LLC as registered with the IRS.

- Type of Entity: Confirmation of your business structure (e.g., Limited Liability Company).

- Date of Issue: The date your EIN was assigned.

Why is it Important?

- Proof of EIN: It serves as official documentation of your EIN.

- Required by Some Institutions: Some banks, financial institutions, and government agencies may require a copy of the EIN Confirmation Letter to verify your business’s identity.

- Important Record: Keep it with your other important business documents for future reference.

The EIN Confirmation Letter is a valuable document that confirms your EIN and provides essential information about your Alabama LLC. Make sure to download it immediately if you applied online, or keep it safe if you received it by mail.

Opening a Business Bank Account for Your Alabama LLC

Once you have your EIN in hand, it’s time to open a business bank account for your Alabama LLC. This is a crucial step in separating your personal and business finances, which is essential for liability protection and maintaining accurate financial records.

What You’ll Need:

Most banks require the following documents to open a business bank account for an LLC:

- EIN Confirmation Letter (or EIN Verification Letter): This confirms your LLC’s EIN with the IRS. Certificate of Formation: This document proves that your LLC is officially registered with the state of Alabama.

- Operating Agreement: This outlines the ownership and management structure of your LLC.

- Personal Identification: You’ll likely need to provide a valid driver’s license or other government-issued identification.

Recommended Banks:

We’ve compiled a list of recommended banks for LLCs, along with the specific documents they require:

- Chase Bank

- Mercury

- Transfer Wise

- Payoneer

Non-US Residents:

If you’re a non-US resident, you can still open a US bank account for your Alabama LLC. However, the process may be slightly more complex. We provide guidance and resources on this page Business Bank Accounts

Benefits of a Business Bank Account:

- Liability Protection: Separating your personal and business finances helps protect your personal assets from business liabilities.

- Professionalism: It enhances your business credibility and makes it easier to track income and expenses.

- Simplified Taxes: A separate bank account simplifies tax preparation and helps ensure accurate record-keeping.

- Access to Credit: It can make it easier to obtain business loans, lines of credit, and credit cards.

Opening a business bank account is a crucial step for any Alabama LLC. By gathering the necessary documents and choosing a bank that meets your needs, you can establish a solid financial foundation for your business.

Need Help with Your EIN Application? Contact the IRS

If you have questions about the EIN application process or encounter any issues, you can contact the IRS directly for assistance.

IRS Contact Information:

- Phone: 1-800-829-4933

- Hours: 7:00 AM to 7:00 PM, Monday through Friday

Reaching a Live Person:

Navigating the IRS phone system can be tricky. Here’s how to reach a live person for EIN assistance:

- Press 1 for English.

- Press 1 for Employer Identification Numbers.

- Press 3 for “If you already have an EIN, but you can’t remember it, etc.”

Important Note: Pressing option 3 is currently the only way to connect with a live representative for EIN help.

Tips for Calling the IRS:

- Call early: Try calling right when they open to avoid long wait times.

- Be prepared: Have your LLC information and any relevant documents handy.

- Be patient: Wait times can vary, so be prepared to be on hold.

What the IRS Can Help With:

While the IRS can’t provide legal or tax advice, they can answer questions about the EIN application process, such as:

- Eligibility requirements

- Application procedures

- Correcting errors on your application

- Checking the status of your application

Don’t hesitate to contact the IRS if you need help with your EIN application. They can provide valuable assistance and guidance to ensure you obtain your EIN successfully.

Common EIN Mistakes and How to Fix Them

Even with a straightforward process, mistakes can happen when applying for an EIN. Here’s a guide to common errors and how to resolve them.

1. Lost or Missing EIN Confirmation Letter

- Problem: You lost your EIN Confirmation Letter (CP 575) or forgot to download it after applying online.

- Solution: Request an EIN Verification Letter (147C) from the IRS. This serves the same purpose as the Confirmation Letter and is accepted by banks and government agencies.

2. Confusing EIN with LLC Formation

- Problem: You thought applying for an EIN automatically formed your LLC.

- Solution: Remember that EINs are for tax purposes and don’t formally establish your business. You must first form your LLC with the state of Alabama and then obtain an EIN. If you’ve been operating with only an EIN, you’ve been operating as a sole proprietorship. To correct this, form your LLC and then apply for a new EIN, canceling the old one later.

3. Applying for EIN Before LLC Approval

- Problem: You applied for an EIN before your LLC was approved.

- Solution:

- If your LLC is approved with the same name used on your EIN application, you’re fine.

- If your LLC is rejected, refile with the state using a different name, obtain a new EIN, and cancel the old one.

4. Needing to Cancel an EIN

- Problem: You need to cancel an EIN due to an error or business closure.

- Solution: Mail a cancellation letter to the IRS.

Mistakes happen, but most EIN errors can be easily corrected. By understanding these common issues and their solutions, you can ensure your EIN application process is smooth and hassle-free.

Frequently Asked Questions

Do I need an EIN if my LLC doesn't have any employees?

Even if you don’t have employees, you might still need an EIN for other reasons, such as opening a bank account or filing certain types of taxes.

What if I lose my EIN confirmation letter?

You can request an EIN Verification Letter (147C) from the IRS.

What if I applied for an EIN before my LLC was approved?

If your LLC is approved with the same name you used on your EIN application, you’re good to go! If your LLC is rejected, you’ll need to get a new EIN after your LLC is approved with the new name.

About Us

We specialize in guiding individuals through the process of forming LLCs across all states, while also offering a range of comprehensive business services tailored to entrepreneurs.

Basics

Our Services

contact details

- support@uniprime.online

- +1 (646) 347-3833

- 1494 State St, Schenectady, NY 12304,