Obtain a Free Alaska EIN Number for Your LLC

(2025 Guide)

2025 LLC Guide

Special Offer alert!

forms your LLC with Northwest for $39 (60% off). Details inside.

How to Get an Alaska EIN Number for Your LLC (Easy Guide)

Learn how to get an Alaska EIN number for your LLC, for free Step-by-step instructions simplify the process

Interacting with the IRS may seem daunting, but acquiring an EIN for your LLC doesn’t need to be overwhelming.

This page clarifies what an EIN is and offers detailed, step-by-step guidance to obtain an EIN for free for an Alaska LLC.

What is an EIN Number?

An EIN, or Employer Identification Number, is a unique identifier given to your LLC by the Internal Revenue Service (IRS), a branch of the federal government. This number functions like a Social Security Number for your business, serving as its unique identifier with the IRS. You might also consider the EIN as your business’s “account number” with the IRS.

Important: The Alaska Department of Commerce does not issue EINs. They are exclusively issued by the IRS.

EIN Synonyms

Your EIN Number may be mentioned in various terms, but they all refer to the same thing. Other names for an EIN include:

- EIN Number

- Employer Identification Number

- Federal Employer Identification Number (FEIN)

- Federal Tax ID Numbers

- Alaska Federal Tax ID Number

- Federal Tax Identification Number

Note: An EIN Number differs from an Alaska Tax ID Number. The IRS issues an EIN, while the Alaska Tax ID Number comes from the Alaska Department of Revenue.

What is the purpose of an EIN?

An Employer Identification Number (EIN) serves multiple government entities in recognizing your LLC.

Possessing an EIN for your Alaska Limited Liability Company allows you to:

- Open a business bank account for your LLC

- File federal, state, and local tax returns, including Alaska income tax

- Register for sales tax

- Secure lines of credit or business loans

- Obtain a business credit card for your LLC

- Apply for necessary business licenses or permits

- Manage employee payroll, if applicable

What is the cost of obtaining an EIN?

Acquiring an EIN for your Alaska LLC is entirely without charge. The IRS offers the EIN online application at no cost.

When is the right time to obtain an EIN?

Ensure your Alaska LLC is approved before applying for an EIN.

Advice: If you obtained an EIN prior to your LLC’s approval, or encountered another error, check our FAQs below. We provide solutions for the most frequent EIN errors.

How to Apply for an EIN for Your Alaska LLC

Getting an EIN for your Alaska LLC is essential, and thankfully, it’s a free and relatively simple process. Here’s a breakdown of how to apply

Understanding Your EIN Confirmation Letter (CP 575)

For US Citizens and Residents

If you have a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), the easiest and fastest way to apply for an EIN is online.

- Online Application: The IRS website offers a streamlined online application that takes about 15 minutes to complete. You’ll receive your EIN immediately upon submission.

- Step-by-Step Instructions: We provide detailed instructions on how to apply for an EIN online here

Alternative Methods (Not Recommended):

You can also apply for an EIN by mail or fax, but these methods are significantly slower. Only use them if you encounter an error with the online application and the IRS instructs you to do so.

For Non-US Residents:

If you’re a non-US resident and don’t have an SSN or ITIN, you can still obtain an EIN for your Alaska LLC. However, you cannot apply online.

- Form SS-4: You’ll need to complete Form SS-4 (Application for Employer Identification Number) and mail or fax it to the IRS.

- Step-by-Step Instructions: We provide detailed instructions on how to apply for an EIN without an SSN or ITIN here

No Need for a Third-Party Designee:

You can apply for an EIN yourself without hiring a third-party designee.

Applying for an EIN for your Alaska LLC is a crucial step in establishing your business. By following these instructions and choosing the appropriate application method, you can obtain your EIN quickly and easily.

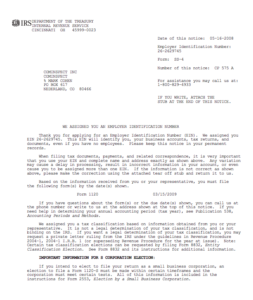

After the IRS approves your EIN application for your Alaska LLC, they’ll send you an official confirmation: the EIN Confirmation Letter (CP 575). This letter serves as proof of your EIN and contains important information about your business.

How You Receive Your EIN Confirmation Letter:

- Online Application: If you applied for your EIN online, you can usually download the EIN Confirmation Letter immediately after completing the application.

- Mail or Fax Application: If you applied by mail or fax using Form SS-4, the IRS will mail the EIN Confirmation Letter to the address you provided on the form. This can take a few weeks.

What the EIN Confirmation Letter Looks Like:

Important Information on the EIN Confirmation Letter:

- Your EIN: The unique nine-digit number assigned to your LLC.

- Legal Name and Address of Your Business: The official name and address of your LLC as registered with the IRS.

- Type of Entity: Confirmation of your business structure (e.g., Limited Liability Company).

- Date of Issue: The date your EIN was assigned.

Why is it Important?

- Proof of EIN: It serves as official documentation of your EIN.

- Required by Some Institutions: Some banks, financial institutions, and government agencies may require a copy of the EIN Confirmation Letter to verify your business’s identity.

- Important Record: Keep it with your other important business documents for future reference.

The EIN Confirmation Letter is a valuable document that confirms your EIN and provides essential information about your Alaska LLC. Make sure to download it immediately if you applied online, or keep it safe if you received it by mail.

LLC Business Bank Account

Once you have your EIN, you can set up a business bank account for your Alaska LLC. To proceed, the bank will require your EIN Confirmation Letter (or EIN Verification Letter). For suggestions on banks and the necessary documents, please refer to business bank account for LLC.

Even if you’re not a US resident, opening a US bank account for your LLC is still possible. For more information, check out this page: Non-US resident opening US bank account for an LLC.

Internal Revenue Service (IRS) Contact Details

For inquiries, contact the Internal Revenue Service (IRS) at 1-800-829-4933. Their business hours are 7am to 7pm, Monday to Friday.

To talk to a live representative, follow these steps: Press 1 for English, then press 1 for Employer Identification Numbers, and finally, press 3 for assistance with remembering your EIN, among other issues.

Note: Option 3 is the only way to reach a live person.

We suggest calling the IRS just as they open to minimize wait times.

Please note, the IRS does not offer legal assistance, legal guidance, or tax advice, but they can help with inquiries about the EIN application process.

Common EIN Mistakes and Solutions

How can I locate my EIN number online?

If you’ve misplaced your EIN Confirmation Letter (CP 575) or forgot to download it, you cannot get a duplicate. However, you can request an EIN Verification Letter (147C) as a replacement.

This document is equally accepted by banks and state government authorities.

I assumed obtaining an EIN is equivalent to forming my LLC, right?

Actually, acquiring an EIN from the IRS does not establish an LLC. LLCs are formed through your state, not the IRS.

You should first establish an LLC in your state and then apply for an EIN, also known as a Federal Tax ID Number. If you’re running your business with just an EIN and haven’t formed an LLC, you’re unknowingly operating as a Sole Proprietorship, with the EIN linked to you personally.

This means the EIN isn’t connected to your business, as the LLC hasn’t been created yet. To transition to an LLC, first set up your LLC, await approval, then apply for a new EIN. You can later cancel the initial EIN.

What if I applied for an EIN before my LLC was approved?

If your LLC is approved with the name used in your EIN application, there’s no issue. As long as the names on your EIN Confirmation Letter and LLC match, you can use that EIN for your LLC.

If the LLC is rejected, you must reapply with the state, await new approval, then obtain a new EIN from the IRS and cancel the previous one.

How do I cancel an EIN?

To cancel your EIN, send a cancellation letter to the IRS. Instructions and a sample cancellation letter can be found here: How to cancel an EIN.

EIN Frequently Asked Questions

Does a Single-Member LLC need an EIN?

Although some articles suggest that Single-Member LLCs don’t require an EIN, it’s not advisable to skip it. An EIN helps protect against identity theft and serves several purposes beyond tax filing. Your Alaska LLC will need an EIN to:

– Open a business bank account

– Secure business lines of credit or loans

– Obtain a business credit card

– Apply for business licenses or permits

– Manage employee payroll (if necessary)

Applying for an EIN is free and takes about 10 minutes online. We highly recommend obtaining an EIN for your Single-Member LLC.

Does a Multi-Member LLC need an EIN?

Absolutely, all Multi-Member LLCs must obtain an EIN from the IRS, as mandated by the Internal Revenue Code.

You cannot file the necessary business tax returns without it, since Multi-Member LLCs are treated as Partnerships by the IRS, unless you opt to be taxed as a Corporation, in which case an EIN is still required.

Do I need an EIN for my DBA?

No, a DBA cannot have its own EIN. Remember, a DBA is simply a trade name for a business or individual(s). However, the entity or person(s) owning the DBA might need an EIN.

DBA owned by an LLC: Your LLC requires its own EIN. If your LLC has a DBA, do not obtain a separate EIN for the DBA. The IRS does not recognize DBAs as separate entities.

DBA owned by individual(s): If you registered a DBA without forming a legal entity like an LLC, you operate as a Sole Proprietorship (1 owner) or a General Partnership (2 or more owners).

Sole Proprietorship: Your Alaska Sole Proprietorship, with or without a DBA, doesn’t need an EIN but may opt for one.

General Partnership: Your Alaska General Partnership, with or without a DBA, must have an EIN as required by the IRS.

In both scenarios, the DBA itself doesn’t get the EIN; the underlying business entity does.

Do I need an EIN for an LLC with no employees?

Yes, it’s advisable to get an EIN for your Alaska business even without employees. The term Employer Identification Number doesn’t imply you must hire employees. The EIN is simply the IRS’s way of identifying your business.

(Note: As a sole owner, you are not considered an employee, just the owner.)

How should a husband and wife LLC get an EIN?

In most states, husband and wife LLCs are treated as Multi-Member LLCs taxed as Partnerships. However, in community property states, couples can choose between:

- Husband and wife LLC taxed as a Partnership

- Husband and wife LLC taxed as a Single-Member LLC (Qualified Joint Venture)

Alaska is not a community property state, so husband and wife LLCs there cannot be taxed as a Qualified Joint Venture (Single-Member LLC).

The way you complete your EIN application will determine your LLC’s tax status. For more information, see Husband and Wife LLC (Qualified Joint Venture).

About Us

We specialize in guiding individuals through the process of forming LLCs across all states, while also offering a range of comprehensive business services tailored to entrepreneurs.

Basics

Our Services

contact details

- support@uniprime.online

- +1 (646) 347-3833

- 1494 State St, Schenectady, NY 12304,