Qualified Joint Venture (Husband and Wife LLC)

2025 LLC Guide

Can a husband and wife LLC be a Single-Member LLC or a Multi-Member LLC?

Disclaimer: There are legal and tax considerations that will be unique to your situation and your state of residency. This article is simply an educational overview and is not legal, financial, or tax advice. We recommend speaking with your accountant and lawyer before making any final decisions.

As another “disclaimer”, this article is specifically about a husband and wife LLC making the Qualified Joint Venture election as per IRS Revenue Procedure 2002-69. Other husband and wife businesses may also qualify for the Qualified Joint Venture election, however, we won’t be discussing that here.

A Qualified Joint Venture (LLC) is an election made with the IRS for husband and wife LLCs allowing them not to be taxed as a Partnership (and therefore being taxed as a disregarded entity).

By default, multi-member LLCs are taxed as a Partnership with the IRS, however, the IRS allows for husband and wife LLCs (which meet the requirements below) to be treated as “one unit”.

This allows the husband and wife to file one tax return instead of two, reduce accounting fees, reduce paperwork, and save time regarding record keeping.

Married Couple Single-Member LLC

Another way to imply the term Qualified Joint Venture is by using the term “married couple single-member LLC” or “husband and wife single-member LLC”.

But the term “single-member LLC” makes it sound like there is only one person, correct?

That is the case, except for husband and wife-owned LLCs in community property states. In community property states the husband and wife are treated as one “unit” for federal tax purposes.

In the husband and wife’s LLC Operating Agreement (the document which lists who owns the LLC, among other things), instead of listing the membership interests as “John Doe, 50%” and “Mary Doe, 50%”, it’ll be listed as “John and Mary Doe 100%”.

Can a gay married couple or same sex marriage also be treated as a Qualified Joint Venture LLC?

Yes, “husband” and “wife” can be replaced with “spouse”, so long as the marriage was legal (as per state law).

As per the IRS Publication 555 (Community Property) and Answers to Frequently Asked Questions for Individuals of the Same Sex Who Are Married Under State Law, same sex marriages are treated the same as an opposite sex marriage. And the term “spouse” means a person who is legally married to another person, as per state law.

However, if the same sex couple has a civil union, registered domestic partnership, or any other relationship that isn’t considered “marriage” by state law, they are not considered spouses and are not considered a married couple for federal tax purposes.

So anytime you see “husband” or “wife” on this page, you can replace those terms with the broader definition of “spouse”.

Requirements of a Qualified Joint Venture LLC

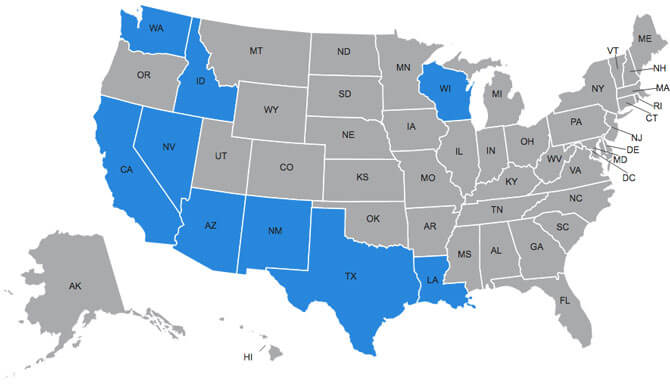

If a married couple forms an LLC in a non-community property state (known as a “common law property state”), they can’t qualify for the Qualified Joint Venture election.

If a married couple forms an LLC in a community property state, they can qualify for the Qualified Joint Venture election, as long as they meet the following requirements (as per Revenue Procedure 2002-69):

- The LLC is formed/created in a community property state

- The married couple are the only LLC owners (there are no other persons or companies that own the LLC)

- Both spouses materially participate in and operate the business

- The married couple files a joint federal income tax return (Form 1040)

- The LLC has not elected to be taxed as a Corporation under 26 CFR 301.7701-2

Community Property States:

- Arizona

- California

- Idaho

- Louisiana

- Nevada

- New Mexico

- Texas

- Washington

- Wisconsin

Note: In California, an LLC owned by Registered Domestic Partners is not allowed to use a Qualified Joint Venture. Instead, the LLC must be taxed as a Partnership.

Advantages of Husband and Wife Qualified Joint Venture LLC?

The advantages of a Qualified Joint Venture LLC are:

1. Save time: The married couple eliminates the extra paperwork and record-keeping requirements of a Partnership.

2. Save money: The married couple saves money on accounting and tax preparation. Instead of the need to file a Partnership 1065 return, K-1s, and then a separate 1040 for each spouse, the married couple’s accountant will just file a Schedule C along with Form 1040 for just one spouse.

3. Social security and Medicare: The married couple can get additional credit for paying Social Security and Medicare taxes (without actually having to pay more in taxes).

How Can a Married Couple Form a Single-Member LLC?

Here are the step to forming a husband and wife single-member LLC:

1. LLC Name

Select your desired LLC name.

2. Registered Agent

Designate your LLC’s Registered Agent.

3. Articles of Organization (or similar form)

File your LLC filing forms with the Secretary of State’s office. This document is usually called the Articles of Organization, but in a few states it may be called Certificate of Organization or Certificate of Formation.

If your state’s Articles of Organization asks for the LLC members, do not list “John Doe” and “Mary Doe” on two lines. Instead, list “John and Mary Doe” on one line.

Tip: If your state rejects your LLC filing forms with “John and Mary Doe” on one line, just re-file with “John Doe” and “Mary Doe” on two lines. You can later designate the single ownership unit in your LLC’s Operating Agreement and when obtaining your EIN from the IRS.

4. LLC Operating Agreement

Draft your LLC’s Operating Agreement. List the LLC member as “John and Mary Doe” and later when the Operating Agreement asks for the capital contributions, list that financial amount alongside the ownership percentage as “John and Mary Doe, 100%”.

5. Federal Tax ID Number (aka EIN)

Obtain your Federal Tax ID Number (also called EIN) from the IRS. Use the IRS EIN online application. After you select your state, the IRS will ask if you are a husband and wife company. Select yes. Then on the next page, the IRS will ask if you’d like to be taxed as a multi-member LLC (Partnership taxation) or a single-member LLC (Qualified Joint Venture taxation). You’ll select single-member LLC.

Note: After your EIN is issued by the IRS, they will provide you with an EIN Confirmation Letter. At the top of the letter you will only see one of the spouses’ names and the abbreviation “SOLE MBR“. Don’t be alarmed though, your Qualified Joint Venture election has been noted by the IRS. Further, you aren’t technically “making the election” by obtaining your EIN. As stated in Revenue Procedure 2002-69 (section 4), however you choose to file your taxes (whether as a Partnership or a Qualified Joint Venture), the IRS will accept.

How to Change Husband Wife Partnership LLC to a Qualified Joint Venture?

Do you have an existing husband and wife LLC taxed as a Partnership and want to change it to a Qualified Joint Venture?

Here are the steps:

1. Make sure the LLC is formed in a community property state and you meet the requirements listed above.

2. Download this Qualified Joint Venture notification letter.

3. Mail your letter to the IRS.

Depending on the state where your LLC is located, you’ll mail your letter to either Kansas City, Missouri or Ogden, Utah:

Department of the Treasury

Internal Revenue Service

Kansas City, MO 64999

OR

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201

Note: There is no street address needed.

To determine which address you should use, please reference this page:

IRS: Where to File Your Taxes (for Form 8832)

(Note: You don’t have to send 8832 to the IRS. You’re just using it to find the mailing address.)

4. Wait 30-45 days for an IRS Confirmation Letter. The letter confirms that the IRS will now recognize your husband and wife LLC as a Qualified Joint Venture.

About Us

We specialize in guiding individuals through the process of forming LLCs across all states, while also offering a range of comprehensive business services tailored to entrepreneurs.

Basics

Our Services

contact details

- support@uniprime.online

- +1 (646) 347-3833

- 1494 State St, Schenectady, NY 12304,